President Biden signed the Inflation Reduction Act of 2022 on August 16th. The bill is currently the most expensive climate change agenda ever approved by Congress. In addition, this bill is super-funding the IRS to increase their ability to crack down on taxpayers. In this article, we’ll break down some of the most important parts of the bill from an individual taxpayer’s perspective, including a few of the tax credits and planning opportunities created by this bill, as well as how the IRS-funding portion of the bill may affect you.

Tax Credits and Opportunities

Health Insurance Changes

The law now extends two American Rescue Plan Act enhancements through tax year 2025. Taxpayers with household incomes ranging $52,000-$106,000 may be eligible for a premium tax credit, depending on their filing status and number of dependents. Additionally, the amount that taxpayers are expected to contribute toward their health insurance premiums will be lowered under the Inflation Reduction Act.

Residential Energy Credits

The existing tax credits used by individuals for home improvements have been expanded and extended. The energy efficient home improvement credit is extended through tax year 2032 and is changed from a lifetime $500 limit to a $1,200 per year limit. The previous credit rate of 10% has also been increased to 30%. Roofs will no longer be qualified property, but the credit has been extended to include more appliances and can even include a home energy audit. These changes apply to property placed in service after December 31, 2022.

In addition, the residential clean energy credit that is mostly used for solar electric systems is extended through tax year 2034.

If you are considering a home improvement, energy efficient appliance purchase, or a solar panel installation soon, you should wait until 2023 to make the improvements, as the tax credits will provide you a bigger benefit than purchases made this year.

Vehicle Tax Credits

There are now three credits available: the clean vehicle credit, a new previously-owned clean vehicle credit of up to $4,000, and a new qualified commercial clean vehicle credit.

The current qualified plug-in vehicle credit, in effect through the end of 2022, requires any vehicle placed in service after August 16, 2022 to have final assembly in North America to qualify. The Department of Energy has provided information on this, including what vehicles qualify, as well as what vehicles have already met the sales cap. However, there is a transition rule that if you entered into a contract between January 1, 2022 and August 15, 2022, and receive the vehicle on or after August 16, 2022, a taxpayer can elect to treat it as placed in service on August 15, 2022.

Another improvement to the electric vehicle credit is that taxpayers can elect to transfer the tax credit to the car dealer to apply to the purchase of the car starting in 2024. This will allow taxpayers with lower incomes to purchase electric vehicles by receiving a discount of up to $7,500 by electing to defer the tax credit to the dealer.

To open the vehicle tax credits up to lower income households, the clean vehicle credit and the previously-owned clean vehicle credit are limited based income starting in 2023. Specifically, the income limitations are based on taxpayer’s Adjusted Gross Income plus other nontaxable income such as municipal bond income. The income limitations are cliffs, meaning once you go a dollar over the limit, you won’t qualify for any tax credit. One important planning item is the taxpayer can use income from the lesser of the year of purchase or the year immediately preceding the purchase. The income limitations are the following:

| Clean Vehicle Credit Modified AGI | Previously-Owned Clean Vehicle Credit Modified AGI |

Married Filing Joint or Surviving Spouses | $300,000 | $150,000 |

Head of Household | $225,000 | $112,500 |

All Other Filing Statuses | $150,000 | $75,000 |

One other important limitation of the credit starting in 2023 will be the vehicle price limitation. For new electric vehicles, the credit will only apply to purchases under $55,000 ($80,000 for pickups, SUVs, and vans). For used electric vehicles, only vehicles under $25,000 will apply.

With the income limitations set to begin in 2023, there is a great workaround for business owners looking to purchase an electric vehicle, as there are no income limits for the commercial vehicle credit. If you own a business and you are interested in purchasing an electric vehicle but make too much, call us. The maximum credit amount is $7,500 for vehicles weighing less than 14,000 pounds and goes up to $40,000 for all other vehicles.

IRS Enforcement

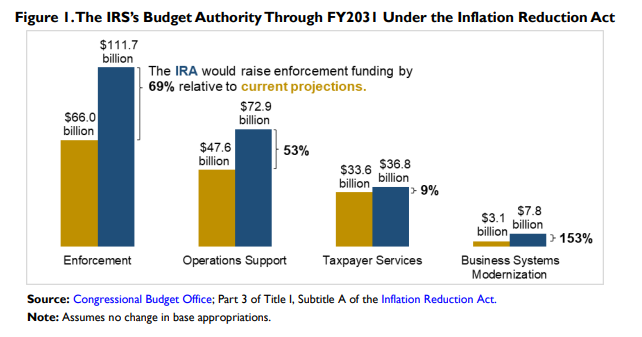

Over the next 10 years, the IRS budget will experience an additional $80 billion of funding. Much of this funding is expected to be spent on enforcement, operations support, taxpayer services, and business systems modernization. Enforcement will receive the largest amount of funds, nearly doubling the enforcement budget over the next 10 years to over $110 billion.

There is a fair amount of fear that this increased enforcement could negatively impact middle and lower-income taxpayers. To address this, Janet Yellen, the Treasury Secretary, sent a letter to IRS Commissioner stating:

“Specifically, I direct that any additional resources—including any new personnel or auditors that are hired—shall not be used to increase the share of small business or households below the $400,000 threshold that are audited relative to historical levels. This means that, contrary to the misinformation from opponents of this legislation, small business or households earning $400,000 per year or less will not see an increase in the chances that they are audited.

Instead, enforcement resources will focus on high-end noncompliance. There, sustained, multiyear funding is so critical to the agency’s ability to make the investments needed to pursue a robust attack on the tax gap by targeting crucial challenges, like large corporations, high-net-worth individuals and complex pass-throughs, where today the IRS has resources to initiate just 7,500 audits annually out of more than 4 million returns received.”

Below are some statistics to show just how low audits have become over the last several years. Over the time from tax years 2016-2019, audits for individual taxpayers have been cut in half.

Tax Year | 2016 | 2017 | 2018 | 2019 |

Individual Tax Returns Filed | 150,447,029 | 153,062,634 | 153,927,628 | 157,951,815 |

Total Audits | 788,090 | 702,574 | 493,913 | 341,845 |

Percentage Audited | 0.52% | 0.45% | 0.32% | 0.22% |

In addition, only 0.05% partnership and 0.06% of S-Corp returns were audited in 2019.

While we do not know how many new examiners will be hired or when they will be ready to conduct audits, we do know the IRS is hungry to show the value of the resources being pushed their way. This is going to come in the form of collections from audits, back taxes, penalties, and interest, particularly from high-net-worth individuals and businesses. Keep in mind that the IRS operates on a 3-year audit cycle, meaning that the taxes you file this year will be primed for audit by new agents in 2-3 years.

Conclusion

The Inflation Reduction Act is an odd title for a bill that does nothing significant to reduce inflation. According to the Penn Wharton Budget Model, a nonpartisan organization that creates economic analysis of the fiscal impact of public policy, there’s “low confidence” that this legislation will have any impact on inflation. Though it completely misses the mark at reducing inflation, the Inflation Reduction Act is one of the more substantial laws to pass through Congress in recent years.

If you have questions about the Inflation Reduction Act, or how it will impact your comprehensive financial plan, schedule a meeting to discuss with us further.

This article is a general communication being provided for informational and educational purposes only and is not meant to be taken as tax advice, investment advice or a recommendation for any specific investment product or strategy. The information contained herein does not take your financial situation, investment objective or risk tolerance into consideration. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting or tax advice from their own counsel. Any examples are hypothetical and for illustration purposes only. All investments involve risk and can lose value, the market value and income from investments may fluctuate in amounts greater than the market. All information discussed herein is current only as of the date of publication and is subject to change at any time without notice. Forecasts may not be realized due to a multitude of factors, including but not limited to, changes in economic conditions, corporate profitability, geopolitical conditions, inflation or US tax policy. This material has been obtained from sources believed to be reliable, but its accuracy, completeness and interpretation cannot be guaranteed.

LEGAL, INVESTMENT AND TAX NOTICE. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

%20-%20Transparent%20bkg%20.png)

Comments